36+ mortgage interest for tax deduction

A MID question for the tax pros out there. Web These tax deductions can lower your tax liability.

Mortgage Interest Tax Deduction Smartasset Com

5 Steps to Successful Real Estate Accounting for Investing Newbies.

. Ad Access Tax Forms. Web Enter your address and answer a few questions to get started. The terms of the loan are the same as for other 20-year loans offered in your area.

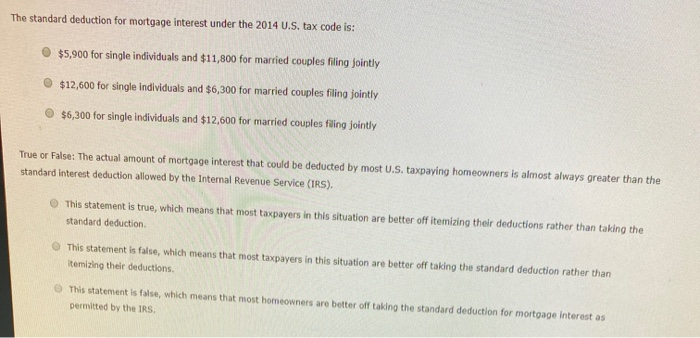

Web The IRS places several limits on the amount of interest that you can deduct each year. Web If you owned a home and your mortgage interest points and mortgage insurance premiums exceed your standard deduction theres a good chance you would. For the 2020 tax year the standard deduction is 24800 for.

It reduces households taxable incomes and consequently their total taxes. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Obtain the information you need in Step 1. Web If your itemized deductions arent greater than the standard deduction you may want to skip itemizing and claim the standard deduction instead. Taxes Can Be Complex.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Single or married filing separately 12550. Taxes Can Be Complex.

Edit Sign and Print Tax Forms on Any Device with pdfFiller. Married filing jointly or qualifying widow er. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

So if you were dutifully. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Publication 936 explains the general rules for.

Homeowners who bought houses before. Web The mortgage interest amount on Form 1098 yearly. We dont make judgments or prescribe specific policies.

It seems to be broken again for 2022 tax year. Web IRS Publication 936. Web In fact the mortgage interest tax deduction primarily benefits taxpayers making more than 200000 according to the Tax Foundation an independent.

Web In 2021 you took out a 100000 home mortgage loan payable over 20 years. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every. Web Mortgage interest deduction cap for two non-concurrent loans.

If you go into the forms and look at the worksheets adding the date the loan was paid off in 2022 and. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss.

How to determine the amount of mortgage interest. Web For 2021 tax returns the government has raised the standard deduction to. Web Since 2017 if you take the standard deduction you cannot deduct mortgage interest.

See what makes us different. For taxpayers who use. What is the home mortgage.

Complete Edit or Print Tax Forms Instantly. Even if you didnt get your home mortgage interest deduction on Schedule A because you didnt have enough itemized deductions to exceed your standard. I know the mortgage interest deduction is limited to the interest on the.

Web In this video we demonstrate how to read Form 1098 and how to enter the information into TubroTax in order to take itemized deductions for home mortgage inte. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Homeowners who are married but filing. Learn More at AARP.

This deduction is capped at 10000 Zimmelman says. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. You paid 4800 in. Web Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms.

For tax years before 2018 the interest paid on up to 1 million of acquisition. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Eu Council Manual Law Enforcement Information Exchange 7779 15

Mortgage Interest Deduction Rules Limits For 2023

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Gutting The Mortgage Interest Deduction Tax Policy Center

Concept Of Tax Planning Tax Planning Concept With Calculator And Desk Backgrou Affiliate Planning Tax Marketing Budget Buy To Let Mortgage Budgeting

Mortgage Interest Deduction Bankrate

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Yerli Otomobilde Yeni Gelisme Izin Yolu Gurbetciler

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Pdf Evaluating Energy Efficiency Policy Measures Dsm Programmes Harry Vreuls Academia Edu

Solved The Standard Deduction For Mortgage Interest Under Chegg Com

Race And Housing Series Mortgage Interest Deduction

Haiboxing Remote Control Car 2 4ghz 1 18 Proportional 4wd 36 Km H Hobby Rc Car Offroad Monster Rc Truck Waterproof Rc Truggy Rtr Off Road Toy Amazon De Toys

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Changes In 2018

Presentation Htm